BAKU, Azerbaijan, May 8. Since investing in stock indices, the State Oil Fund of Azerbaijan (SOFAZ) has earned more than $5 billion, the Azerbaijani State Oil Fund (SOFAZ) told Trend.

Since 2012, SOFAZ, in order to diversify its investment portfolio, has started investing in shares through stock indices. Since the period of implementation of this strategy, as of March 31, 2024, the profit has amounted to $5.3 billion, or 226 percent. It should be emphasized that SOFAZ places great importance on diversifying the investment portfolio across all types of assets, including equities.

The fund noted that most institutional investors, including SOFAZ, such as sovereign wealth funds and pension funds, utilize a passive management strategy in making their investments in listed equities.

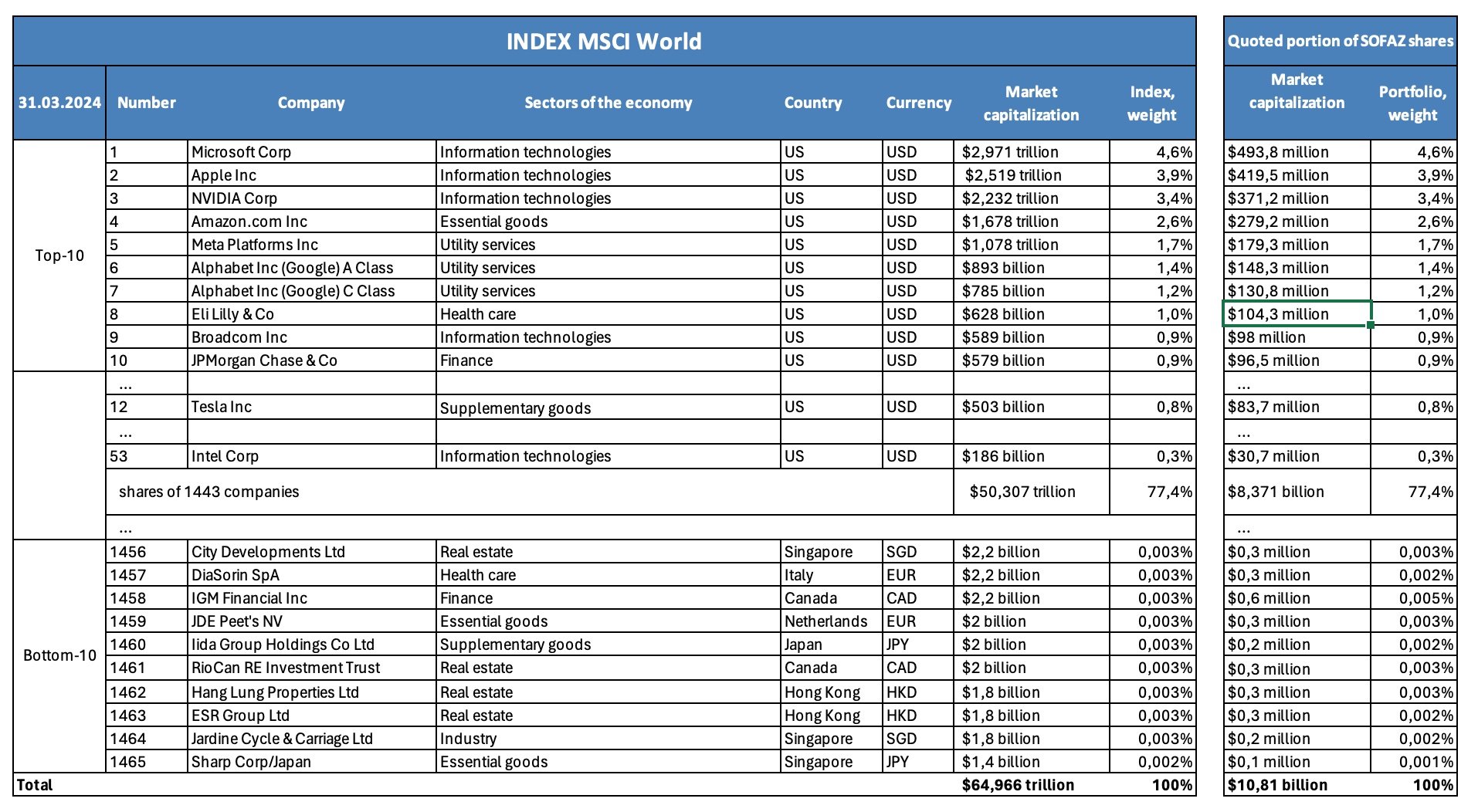

Additionally, it should be noted that SOFAZ stock index strategy implies not active selection of shares of certain companies but passive investment in all shares included in the global index, which consists of more than 1,400 companies, in proportion to their market capitalization.

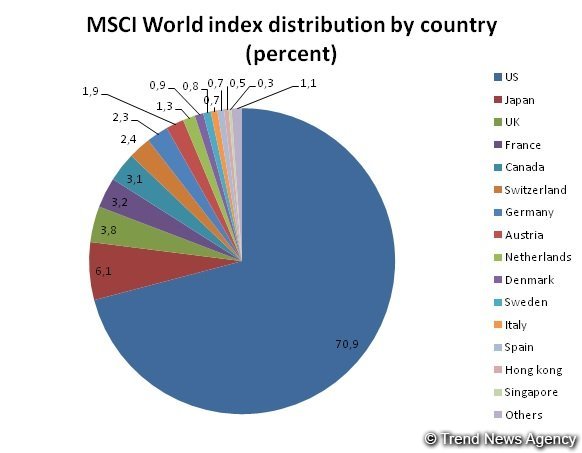

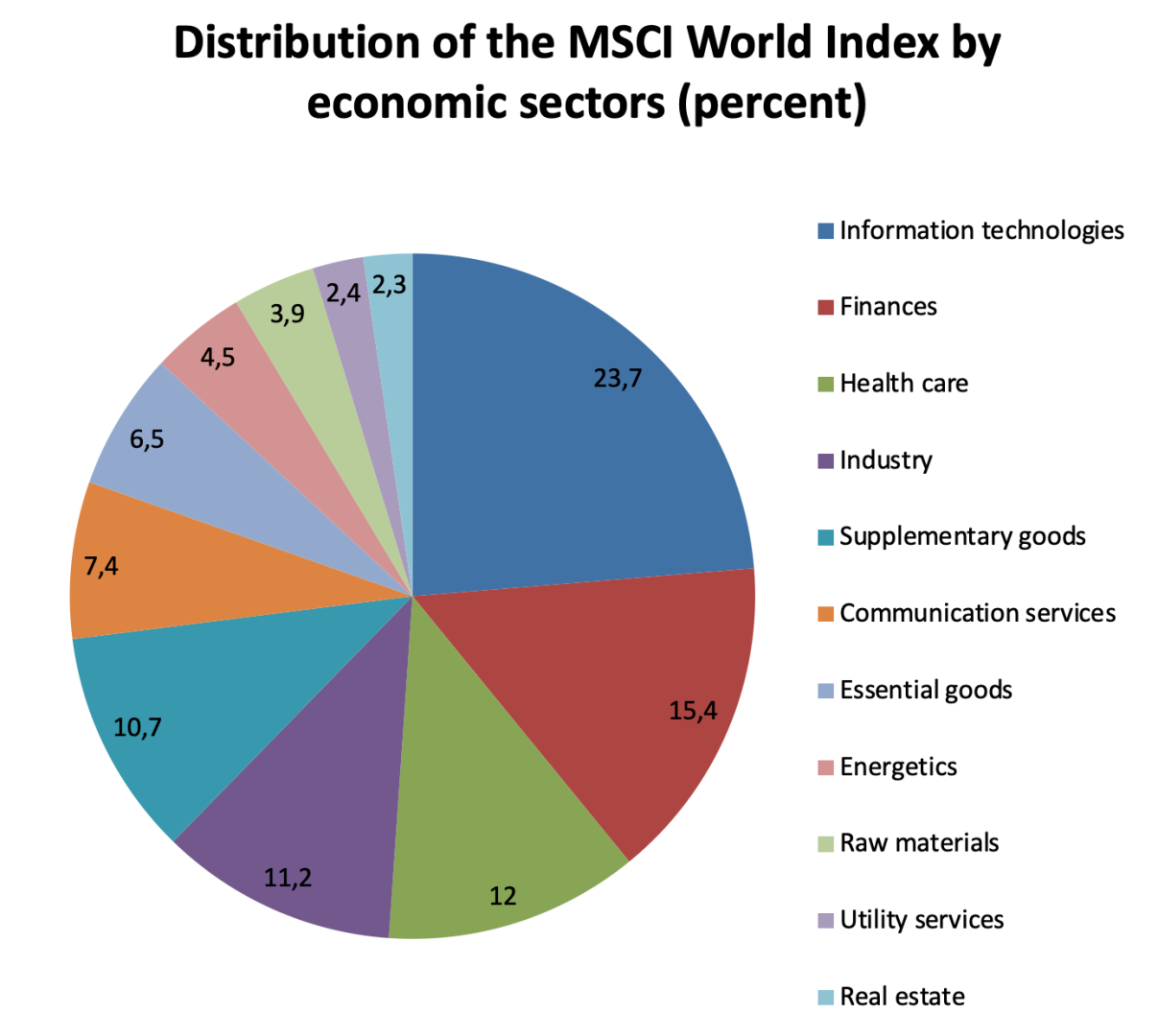

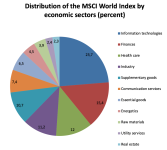

"While investing in shares on the stock exchange, the fund replicates the MSCI World Index [Morgan Stanley Capital International World Index], which consists of the largest companies of the developed world, taking into account the weight of the companies included in this index. The MSCI World index, which is the predominant part of the SOFAZ share portfolio, consists of shares of 1,465 companies (the total market capitalization of which is about $70 trillion), covering 11 sectors of the economy in 23 developed countries of the world," the fund noted.

MSCI World Index tracking indicators (as of March 31, 2024)

Besides, it is worth noting that in addition to tracking the MSCI World index, part of the SOFAZ equity portfolio worth $1.6 billion is invested in the euro-denominated MSCI Europe ex UK index.

“In connection with the recent news in the media, we would like to state that after the inclusion of Tesla and Intel shares in the SOFAZ portfolio (Intel shares since 2012, since the creation of the stock portfolio, and Tesla shares since 2013, since the inclusion in the MSCI World index), the weight of these shares in the SOFAZ portfolio corresponded to the weight of the same shares in the MSCI index. Generally, a stock index is an aggregate of shares of publicly traded companies from different regions, countries, economic sectors, and other factors. Examples of such indices are S&P 500 (500 largest companies of the US stock market), STOXX Europe 600 (600 small, medium, and large companies of developed European countries), and NASDAQ 100 Technology Sector (100 largest technology companies)," the Fund noted.

MSCI World index distribution by country and economic sectors (as of March 31, 2024)

"It should be noted that tracking an index under passive management involves building a portfolio by investing in stocks included in the index according to their weighting in the index. Additionally, we would like to state that SOFAZ does not invest in Exchange-traded funds (ETFs) or Mutual Funds but directly buys shares of companies included in the index," SOFAZ stated.

Key indicators and return on SOFAZ's investments in listed equities in developed countries (as of March 31, 2024)

|

Invested funds |

$7,1 billion |

|

Profit |

$5,3 billion |

|

Current value |

$12,4 billion |

|

Yield from the moment of portfolio creation |

226 percent |

"We would like to point out once again that SOFAZ implements a passive management strategy rather than a speculative and risky strategy based on the selection of certain stocks. While providing a higher level of diversification, this strategy, like many institutional investors, is more conservative," the fund concluded.