BAKU, Azerbaijan, June 14. The Middle Corridor's expansion and modernization will have a substantial impact on regional commerce in Central Asia, Regional Head of Kyrgyzstan, Tajikistan and Turkmenistan for the European Bank for Reconstruction and Development (EBRD), Ayten Rustamova told Trend in an exclusive interview.

“To supplement the Eurasian Northern Corridor, a research released in June 2023 by the EBRD suggests that the Trans-Caspian Corridor—which will unite Central Asian nations—may be the optimal route for freight transportation. Regional trade within Central Asia, including Turkmenistan, will greatly benefit from the upgrading and expansion of this transport corridor. We believe that Turkmenistan should be part of this undertaking. Our bank is discussing possible infrastructure projects related to the Trans-Caspian Corridor with the authorities of Turkmenistan,” she said.

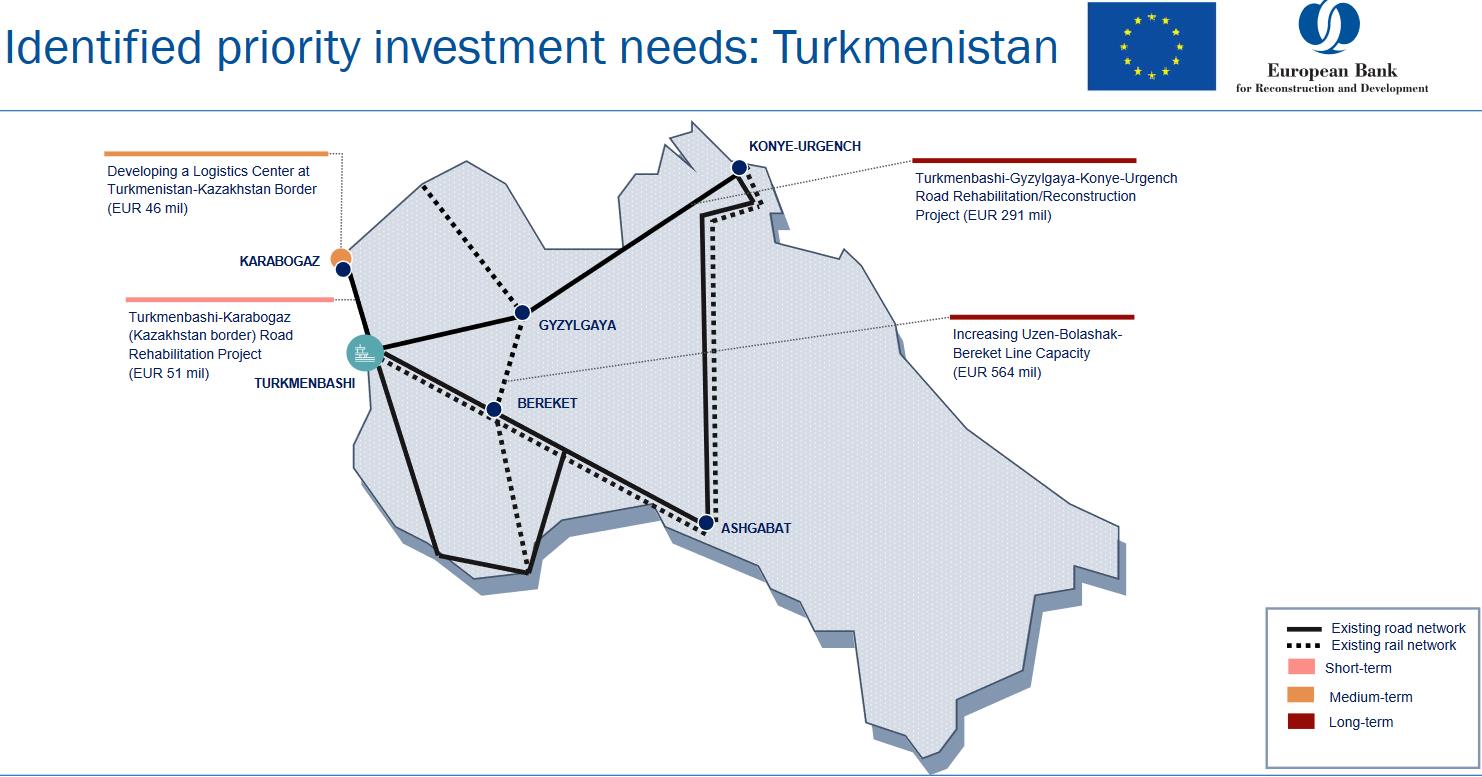

The EBRD revealed that the report has identified the following investment needs for Turkmenistan: developing a logistics center at the Turkmenistan-Kazakh border (46 million euros), the Turkmenbashi-Karabogaz (border with Kazakhstan) road rehabilitation project (51 million euros), the Turkmenbashi-Gyzylgaya-Konye-Urgench road rehabilitation and reconstruction project (291 million euros), as well as an increase in the capacity of the Uzen-Bolashak-Bereket line (564 million euros).

“Our bank stated its readiness to invest around 1.2 billion euros in the Trans-Caspian Corridor related infrastructure and associated transport solutions over the next 2–3 years. We have already invested in a number of transport infrastructure projects, such as a sovereign loan of 44.2 million euros for the reconstruction of a 30 km (Balbay Batyr-Karakol) section of the Issyk-Kul Lake ring road in Kyrgyzstan. As part of the Trans-Caspian Corridor, the upgraded road will improve the country’s transit potential and regional connectivity,” she said.

The initiative will help lower annual CO₂ emissions by 16,000 tons by 2050, according to Rustamova, with funding from the Türkiye-EBRD Cooperation Fund.

"We would also like to mention the financial package of up to 11 million euros to the Kyrgyz Railways national company (Kyrgyz Temir Jolu, or KTJ) organized by the EBRD. It consists of a 12-year sovereign loan of 8 million euros and a 3 million euro grant provided by the EBRD Shareholder Special Fund. The funds will allow KTJ to replace its obsolete open-railcar rolling stock for the transportation of construction materials and agricultural produce," she said.

The regional head highlighted that the KTJ plans to allocate funds towards the restoration of vital railway infrastructure, including the avalanche protection gallery in the Boom gorge.

“In a wider Central Asia region, we are exploring a number of public-private partnership initiatives and sustainable infrastructure projects, that will contribute to the fluidity of cargo traffic across the country and along the Trans-Caspian route,” she added.

Moreover, she mentioned that Mark Bowman, the Vice President for Policy and Partnerships at the EBRD, recently visited Turkmenistan in March 2024 and met with the country’s president, Serdar Berdimuhamedov.

“This was the first visit of a high-ranking EBRD official to the country since 2019. Our Bank expressed its readiness to re-engage with Turkmenistan’s private sector not only through advisory projects but also through lending to companies. Historically, the EBRD has a lot of experience working with local private businesses in Turkmenistan, and we are eager to reengage and expand this cooperation. The EBRD would also be interested in exploring other areas for cooperation, such as water management, green energy, transport connectivity, and work through financial intermediaries. The Bank can use its experience and resources to support bankable projects, that could address the issue of water scarcity in Turkmenistan. It stands ready to explore the country’s potential for the development of renewable energy and tap into the positive experience we have in this field in the neighbouring countries of Central Asia,” Rustamova added.

Additionally, she mentioned that the EBRD re-engaged with Kyrgyzstan's energy sector last year, leading to initiatives that will enhance the country's ability to withstand climate change.

“Last year we had the highest operational result in Kyrgyzstan over the last 5 years, and I am very proud. 67 percent of our projects were in the private sector, and almost 40 percent of these investments were green. In fact, it is our ambition to become a majority green bank by 2025. We played a role in fostering inclusive employment opportunities, supporting innovative entrepreneurial endeavors, and advancing climate-resilient technologies within the country. It would be fair to say that we have an ongoing and fruitful dialogue with the national authorities, which translates into increased public sector lending,” she said.

The bank's largest hydropower investment in 20 years, the regional head said, was a loan to improve the national electricity transmission and distribution grid and a loan to restore and modernize the Lebedinovskaya hydropower plant.

“The EBRD also pledged new funds to support the modernization of water supply services in the Batken and Jalal Abad regions of Kyrgyzstan in the context of its Kyrgyz Water Sector Resilience Framework. Our bank also signed a sovereign loan to upgrade a 30-kilometer section of the Issyk-Kul Lake Ring Road. The project will help modernize key transport infrastructure, which will help improve the country’s connectivity and tourism potential in the Issyk-Kul area,” Rustamova said.

She mentioned that in 2023, the EBRD also wrapped up the Bishkek landfill project, bringing significant environmental advantages to over one million residents in Kyrgyzstan's capital.

“Finally, we continued rolling out our flagship programmes such as the Green Economy Financing Facility, designed to support green and innovative solutions, and Green Cities, helping to tackle environmental challenges and encouraging investment in municipal infrastructure. The Bank also launched a seven-year Youth in Business programme to help youth entrepreneurs and address the issue of employment in Central Asia and Kyrgyzstan,” Rustamova said.

She further pointed out that last year, the EBRD marked 30 years of operations in Tajikistan.

“Over these years, we have enjoyed excellent cooperation with the authorities, both central and regional, and the business community. This allowed us to invest nearly 990 million euros in almost 170 projects in Tajikistan during this period. Our funds have supported good entrepreneurial initiative and essential upgrades in various sectors ranging from energy, water, and transport to banking and small and medium-sized enterprises (SMEs). Our activity in Tajikistan rests on the country strategy approved in 2020 and developed jointly with the government. It is helping to boost the resilience, modernization, and regional integration of the national economy. We have also started country diagnostics in preparation for a new country strategy,” she said.

The regional head noted that during the visit of EBRD President Odile Renaud-Basso to Tajikistan in late April, a memorandum of understanding was signed between the EBRD and the National Bank of Tajikistan to develop the Women Entrepreneurs Finance Code (WE Finance Code).

“This is a commitment by providers of financial services, regulators, development banks, and other stakeholders to jointly increase financial assistance to women-led micro, small, and medium enterprises. Most recently, at the Bank’s Annual Meeting, the EBRD signed deals collectively worth $15 million with Tajikistan's bank Arvand and the microlender HUMO. They will use funds to promote green lending and support women and youth entrepreneurship in Tajikistan,” she said.

Talking about cooperation in agriculture, she pointed out that for almost a decade, the EBRD and the EU worked together on the Enhanced Competitiveness of Tajik Agribusiness Programme.

“It was successfully completed in May 2023 and contributed to the competitiveness and sustainability of Tajikistan’s agribusiness sector, which employs around half of the country’s able population. The EBRD channelled over $24.5 million to over 1,220 farmers across Tajikistan. These loans were provided both directly and through the EBRD partner banks and supported by EU grants worth 5.65 million euros,” she said.

Rustamova pointed out that investments greased the wheels for acquiring cutting-edge tractors, state-of-the-art irrigation systems, top-notch cold storage units, high-tech greenhouses, streamlined poultry production lines, and advanced agriculture processing machinery.

“We are very proud of this experience and look forward to implementing more similar programmes in the future. The EBRD is also sharing risk on loans provided by domestic lenders to local agribusiness producers. For example, we shared half of the risk on the loan extended by Bank Eskhata to leading vegetable grower MMK AGRO,” the regional head added.

She went on to say that the EBRD has recently promised extra funding to make Tajikistan's power supply more stable and long-lasting by setting up a credit line of up to 31 million euros for the country's transmission network operator, Shabaqahoi Intiqoli Barq.

“The facility consists of two EBRD sovereign loans totaling up to 23 million euros and an investment grant of up to 8 million euros. The funds will help rehabilitate the existing transformer and construct a new one at the Sugd-500 substation in the north of the country. The project will also be supported by an investment grant of up to 2 million euros from the Sustainable Infrastructure Fund,” she said.

Rustamova added that this project builds on the success of the EBRD’s recently completed Sugd energy loss-reduction project, which demonstrated the effectiveness of modern metering and billing systems by cutting network losses in the region’s main city of Khujand from 27 percent to 10 percent and by improving payment collections to nearly 100 percent.

“Supported by grant funds from the Sustainable Infrastructure Fund and the Japan-EBRD Cooperation Fund, this project is expected to bring significant environmental benefits to the Sugd region, such as an annual reduction in CO2 emissions of 129,000 tonnes. It will also help to ensure the smooth introduction to the grid of pilot renewable energy projects in the Sugd region,” she said.

The regional head also highlighted the Qairokkum HPP rehabilitation project, where the EBRD mobilised concessional financing from Climate Investment Funds and the Green Climate Fund to finance the modernisation of a 60-year-old hydropower plant that provides electricity to almost 500,000 people

Lastly, when discussing the EBRD's medium-term plans, she said the Kyrgyzstan EBRD country strategy, adopted in 2019, focuses on: fostering sustainable growth by strengthening regional cross-border linkages; enabling SMEs to scale-up and bolster competitiveness; and promoting sustainability of public utilities through commercialisation and private sector participation.

“Our next five-year plan is also now under development,” she said.

Moreover, activity of the bank in Tajikistan rests on the country strategy approved in 2020 and developed jointly with the government. It is aimed at helping to boost the resilience, modernisation, digitalisation and regional integration of the national economy.

“Turkmenistan is refocusing its efforts on the private sector, infrastructure, water, and renewable energy,” Rustamova concluded.