Baku, Azerbaijan, May 4

By Dalga Khatinoglu – Trend:

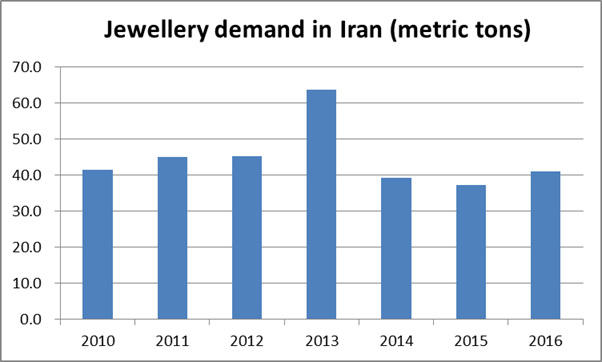

Gold jewellery demand in Iran has jumped up by 27% in 1Q2017, compared to the same period of 2016, according to the World Gold Council’s report.

The report also said the surge in gold demand in Iran is also a 4-year high of 12.9 tons.

Jewellery gold demand in Iran jumped 27 percent in 1Q17 year-on-year to a four-year high of 12.9 tons, helped by an improving economy, World Gold Council said.

The report added that this sector was also boosted by investment-driven purchases, due to a lack of supply of gold coins from the central bank.

The Central Bank of Iran has been issuing Bahar-e Azadi (Spring of Liberty) coins since the 1979 Islamic Revolution in Iran, when the Islamic Republic was founded. Iran’s gold bar and coin demand also was 3.7 tons.

The report also said the demand in Turkey sank to a four-year low of 7.7 metric tons in 1Q17. Continued currency weakness in Turkey meant that the price of gold in lira rose more than in any other currency during Q1 (+12%), undermining the jewellery demand.

“Demand in the Middle East unchanged at 54.6 metric tons in 1Q17. Growth in Iran contrasted with weakness elsewhere. Demand across the rest of the region remained weak in the face of low oil prices and subdued tourist numbers, the impact of which was exaggerated by rising gold prices. Although the UAE has imposed a 5% import duty, demand in that market was relatively robust as consumers rushed to buy before the full effect of the tax fed through to end-user prices,” said the report.

Global jewellery demand in 1Q17 was 480.9 tons, about 1 percent more than 1Q16.

Gold supply contracted sharply in Q1: down 12% to 1032 metric tons, while the demand declined by 18 percent to 1,034.5 metric tons year-on-year.