BAKU, Azerbaijan, June 17. Further escalation in the Middle East could disrupt liquified natural gas (LNG) exports through the Strait of Hormuz, Trend reports citing analysis from Netherlands-based ING banking group.

The ING analysts note that oil and gas markets are once again on edge following remarks by U.S. President Donald Trump, who called for the evacuation of Tehran.

The U.S. President’s comments sharply contrast with earlier hopes that the Israel-Iran conflict could be contained, note the experts, adding that his decision to cut short his G-7 visit has added to concerns about potential U.S. military involvement in the region, reigniting volatility across financial markets.

“These latest developments have added to geopolitical risk premiums,” ING analysts said. “The market is now pricing in greater uncertainty around potential supply disruptions.”

On Monday, reports suggested that Iran had signaled willingness to deescalate tensions and resume nuclear negotiations—on the condition that the U.S. refrains from joining Israeli military operations. Still, the broader market remains wary, with the Strait of Hormuz at the center of global supply concerns.

Almost one-third of global seaborne oil passes through the Strait of Hormuz, making it the world’s most critical energy chokepoint. While there has been no disruption to oil infrastructure or shipping so far, the fear of escalation is pushing oil prices higher.

Oil and gas prices respond

Brent crude rose sharply following Trump’s remarks, as markets braced for a potential supply shock. European natural gas prices also surged, climbing to their highest level since early April after a 4.8% jump last Friday.

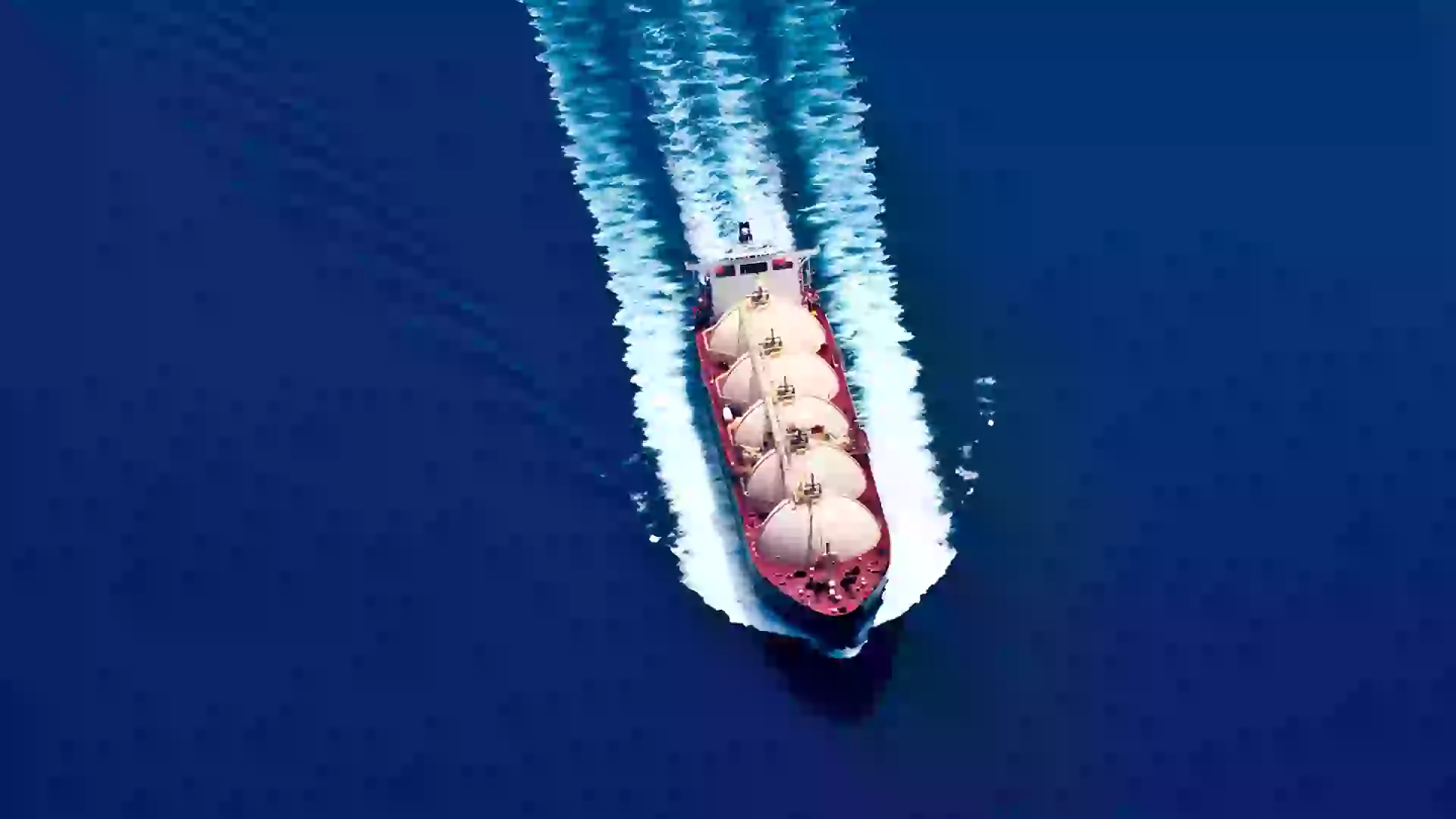

“As with oil, the biggest concern for gas markets is that further escalation could disrupt LNG exports through the Strait of Hormuz,” ING notes.

Qatar, a major LNG exporter, ships roughly 20% of the global LNG supply via this route. Without a viable alternative export corridor, any interruption would significantly tighten global LNG markets and drive prices higher—particularly in Europe.

EU looks to end Russian gas reliance

Meanwhile, the European Commission is expected to unveil new proposals aimed at phasing out the EU’s dependence on Russian gas. The package reportedly includes a gradual ban on Russian pipeline and LNG imports starting January 2026, with a complete phase-out by the end of 2027. The proposals also seek to prohibit EU terminal services to Russian energy firms.

“The twin pressures of geopolitical uncertainty and long-term policy shifts are reshaping global energy flows,” ING analysts concluded.

With tensions in the Middle East showing no sign of easing and strategic supply routes under threat, markets are likely to remain highly reactive to developments in the coming days.